The golden state's advancing home insurance coverage landscape has actually been a hot topic for property owners, but companies across the state are additionally really feeling the impacts. The reforms, developed to address increasing expenses, natural disaster threats, and insurance coverage availability, have presented brand-new challenges and possibilities for companies of all sizes. Recognizing these modifications is essential for entrepreneur, as they browse monetary preparation, danger monitoring, and compliance in an uncertain atmosphere.

The Ripple Effect of Insurance Reforms on Commercial Operations

Home insurance reforms are not nearly homes. When insurers change plans, increase costs, or take out from specific markets, the impacts include commercial realty, business procedures, and the total economic landscape. Firms that have residential property, lease workplace, or count on home monitoring firms have to stay informed about moving insurance plan and their possible impact on costs.

Companies that count on distributor networks and circulation networks might additionally experience disruptions. Higher insurance premiums can lead to increased operating costs, which are frequently passed down the supply chain. When commercial property managers deal with increasing insurance coverage expenses, renters may see rental increases, influencing local business and business owners the most.

For entrepreneur, adapting to these adjustments calls for positive threat evaluation and tactical planning. Partnering with lawful and monetary advisors can aid business reduce unforeseen expenditures and ensure they remain certified with regulative updates.

Rising Costs and the Burden on Business Owners

Among the most instant issues originating from California's home insurance coverage reforms is the increase in prices. As insurance providers adjust to new threat designs, costs for residential property insurance policy have risen. While property owners are straight impacted, organizations that own business spaces or depend upon household markets are likewise really feeling the stress.

Higher building insurance premiums can bring about increased costs for local business owner who handle or rent structures. In industries such as friendliness, real estate, and retail, these expenses can dramatically influence success. Firms must think about reassessing their budget plan appropriations to make up these increases while maintaining financial stability.

Sometimes, companies may need to explore alternative protection choices. This can imply dealing with specialty insurance providers, self-insuring specific risks, or forming strategic collaborations with various other organizations to discuss better prices. No matter the technique, it's necessary for firms to stay informed and seek professional advice when making insurance-related choices.

Legal and Compliance Considerations for Employers

Past economic concerns, governing conformity is one more essential element of California's home insurance reforms. While these regulations largely focus on homeowner plans, they can indirectly influence workplace policies, particularly for services with employees that work from another location or operate from home-based offices.

Companies ought to guarantee they are up to day on anti harassment training needs and work environment safety guidelines, as compliance usually intersects with more comprehensive legal commitments. Understanding exactly how changing insurance coverage regulations might impact liability and worker defenses can help business stay clear of potential legal risks.

In addition, California businesses ought to check shifts in California workers compensation rates as insurance policy changes may affect employees' insurance coverage. Ensuring that employees have sufficient security in case of crashes or property-related cases is important for maintaining a compliant and honest work environment.

Methods for Businesses to Navigate Insurance Challenges

Adapting to California's insurance coverage reforms needs a positive technique. Right here are some crucial methods for services seeking to handle the effect efficiently:

- Review and Update Insurance Policies: Businesses ought to frequently reassess their existing protection to ensure it aligns with brand-new guidelines and prospective risks.

- Reinforce Risk Management Practices: Investing in calamity readiness, safety and security methods, and facilities improvements can help in reducing insurance coverage expenses over time.

- Utilize Industry Networks: Engaging with organizations that offer visit here chamber of commerce membership can give services with important sources, advocacy assistance, and group insurance choices.

- Explore Alternative Coverage Solutions: Self-insurance swimming pools, captives, and specialized policies might provide even more affordable defense for organizations encountering high premiums.

- Remain Informed on Legislative Updates: Monitoring state and government regulatory modifications can help services anticipate future shifts and readjust their techniques appropriately.

The Future of Business Insurance in California

While California's home insurance coverage reforms have actually presented difficulties, they additionally highlight the importance of durability and flexibility for companies. As the regulative landscape remains to evolve, staying positive, educated, and involved with industry groups will be vital for lasting success.

Entrepreneur who make the effort to examine their insurance policy needs, strengthen risk administration methods, and utilize the advantages of chamber of commerce membership will certainly be much better positioned to navigate these modifications. The secret is to continue to be versatile and aggressive in dealing with insurance policy issues while concentrating on lasting growth and stability.

For more insights on how these insurance coverage reforms will continue to form California's organization setting, remain tuned for updates on our blog. We'll keep you educated with professional analysis, regulative news, and practical strategies to aid your service prosper.

Danny Tamberelli Then & Now!

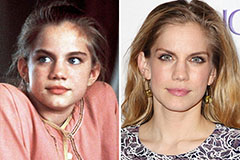

Danny Tamberelli Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!